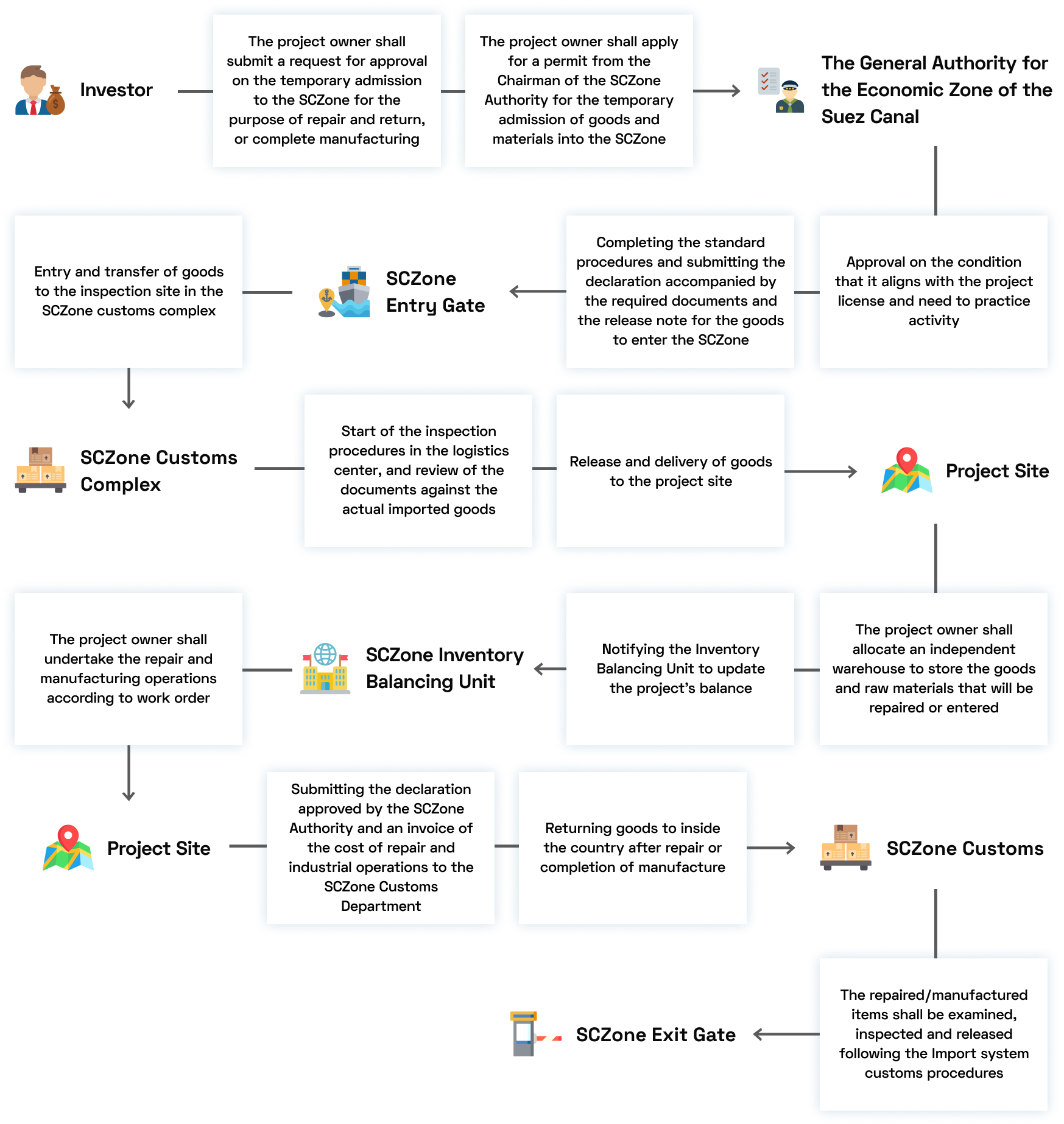

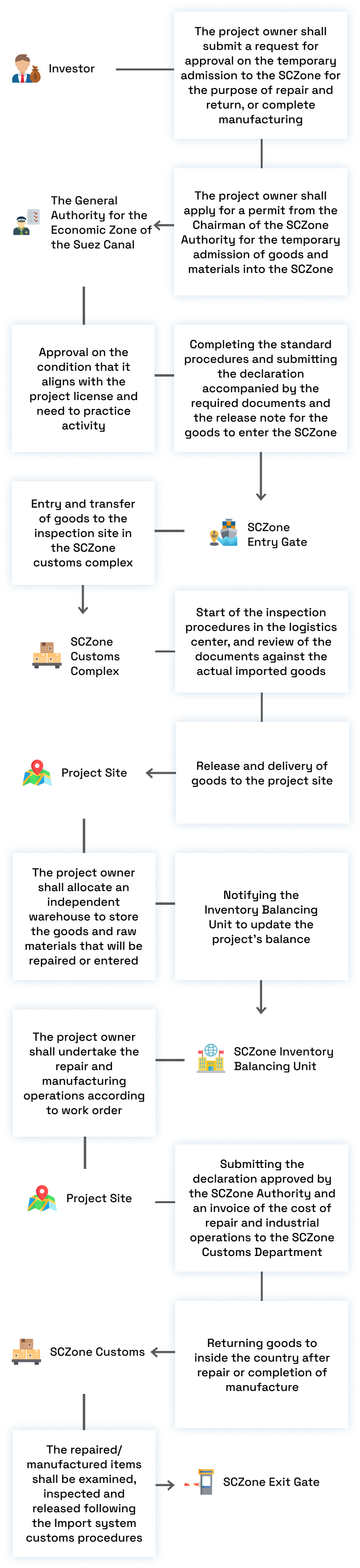

Temporary Export (Temporary Admission / Manufacturing for Others) of the goods of companies operating in the local market to the SCZone

Description and Purpose of Process

These procedures apply to the SCZone industrial projects, its employees, or agents authorized by the validity of a bank signature in favor of the project to finalize the procedures of the temporary admission and manufacturing for other local market companies’ goods in the SCZone projects to repair or perform some complementary industrial operations on the goods and then returning them to the country. All information related to the procedures of the temporary export to the SCZone and to obtaining a permit from the chairman of the board of directors of SCZone General Authority (or their deputy) for the temporary admission (using the related form) of goods, parts and local and foreign raw materials for projects licensed for this activity in the SCZone shall be provided without being bound by the export and import procedures inside the country. Taxes and fees on goods imported from abroad and foreign components that have been used in the repairing process or complementary industrial operations shall be paid when the goods are returned to the country.

Process Diagram

Key Steps of Work Procedures

Starting the registration process of the project in the SCZone, and submitting a request to obtain a permit from the chairman of the board of directors of SCZone General Authority (or their deputy) for the temporary admission (using the related form) of goods, parts and local and foreign raw materials for projects licensed for this activity in the SCZone

Submitting a temporary export declaration attached with (SCZone Authority inbound form – repair or operation contract – packaging list)

Filling the form 126 KM, which shows the data of the temporarily exported goods to verify its specifications on re-import. The form shall be filled at the time of completion of the export procedures

Clarifying the data of the exported items with due diligence and in a way that enables reviewing and checking for conformity and verifying specifications of goods on re-import

The customs complex keeps legal samples, catalogs, or any detailed data on the temporarily exported goods, or put distinctive marks, when necessary, according to the nature of the item

Submitting a pledge from the project’s owner to return the product after finishing the repair/manufacturing process to inside the country

The project licensed to carry out this activity shall allocate

- Separate private store from the project stores for goods, materials, parts and raw materials that will be repaired or operated.

- An account for this activity separated from the account allocated for the main licensed activity of the project.

Transporting the goods to the Economic Zone and completing the inspection procedures

Releasing and delivery of goods to the project, in addition to updating the project’s inventory balance

Regulatory Requirements and Controls

1

A valid commercial register

2

A valid operating license or permit to practice the project activity

3

Tax card

4

The company is registered at the Customs Stakeholder Unit, by virtue of a letter submitted by the SCZone Authority

5

OGA approval – if any

Shipping and Commercial Supporting Documents

1- When entering the SCZone

A permit from the Chairman of the Board of Directors of the SCZone Authority or their deputy

The SCZone Authority’s approval of the inbound form of import from the local market

Repair or operation contracts

Invoices

Packaging list

Form 126K

Legal samples or catalogs

A pledge from the project’s owner to return the product after finishing the repair/manufacturing process to inside the country

Work order

2- When exiting the SCZone

An invoice of the cost of the repair or manufacturing operation

An acknowledgment from the project’s owner stating that these items are the same ones that were allowed to enter the zone.

SCZone Authority Procedures

The stakeholder shall submit to the SCZone Authority an original and 2 copies of the approved temporary admission request for the aforementioned items using the related form and shall attach to it the following:-

- A declaration that includes a statement of the goods items, quantities and types, and the related operations to be carried out, whether repairs or manufacturing operations, and the estimated cost of that, in addition to a statement of the expected percentage of wastage, in case of foreign components are used in manufacturing operations. Also, the declaration states the fixed date of completion of repair or manufacturing operations, and the specific date for releasing such items. The original declaration shall be approved by the SCZone Authority and the Authority shall keep a copy of it.

- The project’s owner undertakes the responsibility of returning products from the SCZone to inside the country after finishing the repair/manufacturing process, or after completing the customs procedures, if the project’s owner has decided to keep them in the SCZone

Customs Procedures in the SCZone Customs Complex

1- The stakeholder or their representative submits the declaration data electronically through one of the following ways:

- EDI system

- XML system

- Online submission through the official portal of the Economic Zone for customs services.

- Direct submission by the employee of the customs logistics center in SCZone.

2-The stakeholder or their representative submits the declaration attached with the above-mentioned documents.

3- The items shall be inspected upon entering the inspection area at the SCZone customs by a committee formed of Customs officers and the SCZone Authority in the presence of the stakeholder. The procedures shall be carried out in accordance with the customs procedures stipulated in the customs procedures {of temporary export declaration}. They may also be inspected in case of directly moving to the project site by following the same procedures.

4- At the end of the customs procedures of the declaration, the original release order with a scanned copy of the invoice and the packing list shall be handed over to the stakeholder or their representative.

5- Another copy of the release order, whether a paper-based or electronic copy, shall be sent to the concerned customs committee in the SCZone to allow entry of the goods.

6- The consignment is delivered to the project’s owner and becomes in their custody and under their responsibility to be transferred to the project site.

7- The customs committee shall submit the admission documents (original and copy of the entry permit attached to the customs declaration) to the SCZone Inventory Balancing unit to add the imported goods to the inventory balance of the project carrying out the repair or industrial operations.

8- The customs declaration file shall be archived in the related archive.

Procedures of Returning Goods to the Country after Repair or Completion of Manufacture:

SCZone Authority Procedures

- The request for release from the SCZone to return goods after repair/reprocessing to inside the country shall be submitted by the concerned parties to the SCZone Authority using the approved related form with an original and two copies. This request is submitted after the completion of repair or industrial process on the goods. The request indicates what has been repaired or manufactured, duration, and estimated cost of such process

- The request shall be attached with a copy of the import declaration of the consignment on entering the SCZone, and a statement from the project acknowledging that these items are the ones permitted to enter the SCZone

- An invoice of the cost of the repair or manufacturing operations shall be submitted. The declaration and its attachments shall be approved by the SCZone Authority, and the Authority shall keep a copy of it

Procedures at SCZone Customs Department

- The stakeholder or their representative shall submit the approved declaration by the SCZone Authority, in addition to an invoice of the cost of the repair or manufacturing operations to the SCZone Customs department, where a committee shall inspect the repaired/manufactured items. This committee is formed of the Customs officers, SCZone officers, and the representative of the project that carried out the repair or manufacture process.

- The repaired/manufactured items shall be released following the Import system customs procedures.

Operational Requirements and Controls

- Empty containers shall be inspected upon entry or exit of the gate and the containers numbers shall be recorded in the containers register and the gate incident book. If the seals of the containers and trucks are not intact, or if the packages arrive in an apparently unsound condition, a detailed inventory of the consignment is made with an inspection report.

- The SCZone projects that follow the temporary admission of goods for repair and reprocessing shall keep a property book.

- In case the seals do not exist or if there is a doubt about their validity, a statement of facts shall be issued and presented to the head of the customs complex and the executive director of the SCZone customs to take the necessary actions.

- Inspection procedures shall not be delayed, and in case of the goods arrival after the official working hours, the stakeholder shall notify the SCZone customs administration and the SCZone administration in advance to take the necessary measures towards preparing the inspection team after the official working hours.

- The owners of projects in the SCZone are not allowed to unload the incoming goods or remove the containers seals before completing the inspection procedures.

- The customs committee follows up on the goods of the approved inbound/outbound forms that have not arrived to or departed from the SCZone in its specified time, and notifies the SCZone Authority to investigate the case.

- Inbound TCDs and release orders to the SCZone, for which the related customs procedures have not been completed on entry to the zone, shall be followed up and the director of the customs complex and the executive director of the SCZone customs unit shall be notified of that immediately on daily basis.

- Complementary operations are exempted the import rules and regulations applied in the country.

- Goods and raw materials that have undergone the transformation operations when returned to the country are subject to the general rules issued by Authority’s Board of Directors in accordance with Article (20) of the Executive Regulations of the Economic Zones Law of a Special Nature.

- Taxes and customs duties on foreign items used in the repair or manufacture process are collected according to their conditions upon entering the SCZone, their value on the date of declaration registration, and the tax value applicable on the date of payment.

Related Important References and Resources

- Law No. 83 of 2002 on Economic Zones of a Special Nature

- Article 20 of the Executive Regulations of Economic Zones of a Special Nature Law

Explanatory Questions and Answers

The local market stakeholder pays the amount of the repair invoice or the manufacturing operations submitted by the project owner, in addition to the taxes and fees on the foreign components used in these operations. The customs tax base thereon shall be the value of the foreign components only at the date of registration of the customs declaration and the applicable tax category at the date of payment.

Yes. Provided that the stakeholder/importer in the local market shall authorize the SCZone project representatives by a valid bank signature or the SCZone Authority shall approve such authorization by the Republic slogan seal where the burden of proof falls on the Authority to prove the seriousness of the import and export process and the stakeholder of the trade process.

It is not required to be registered in the importers and exporters register, but the stakeholder shall have a commercial register and a valid tax registration number.