Export to Local Market (Final Import of Local Market for SCZone Manufactured Goods)

Description and Purpose of the Process

These procedures apply to the SCZone industrial projects, and its employees or agents authorized by the validity of a bank signature in favor of the project to finalize the procedures of exporting the project goods to the local market. All information related to such process and the necessary procedures are provided for the projects to comply with when submitting outbound forms to export goods to local market and get the SCZone Authority’s approval on them. Goods are imported to the local market under the Final Import system from Economic Zones.

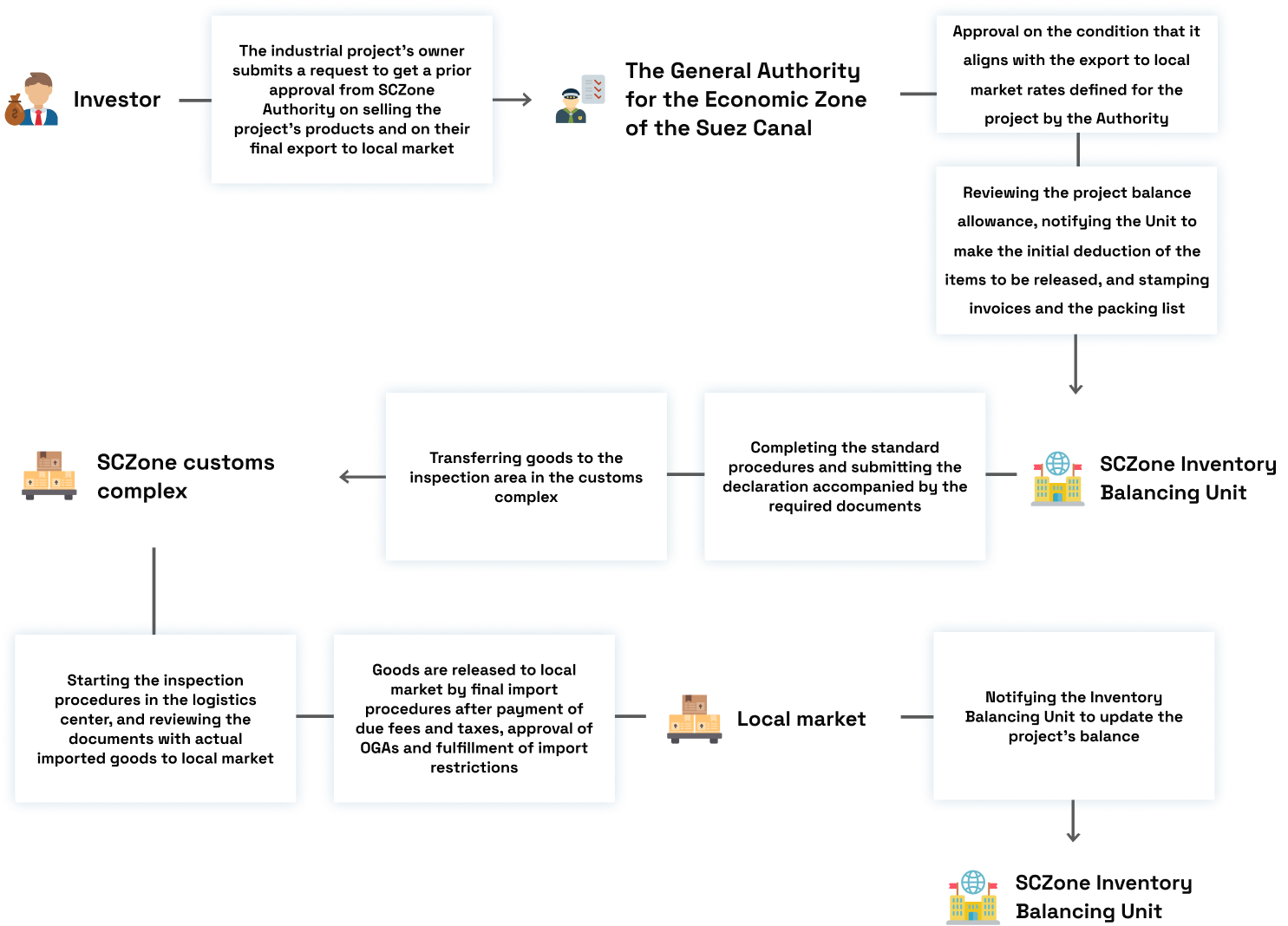

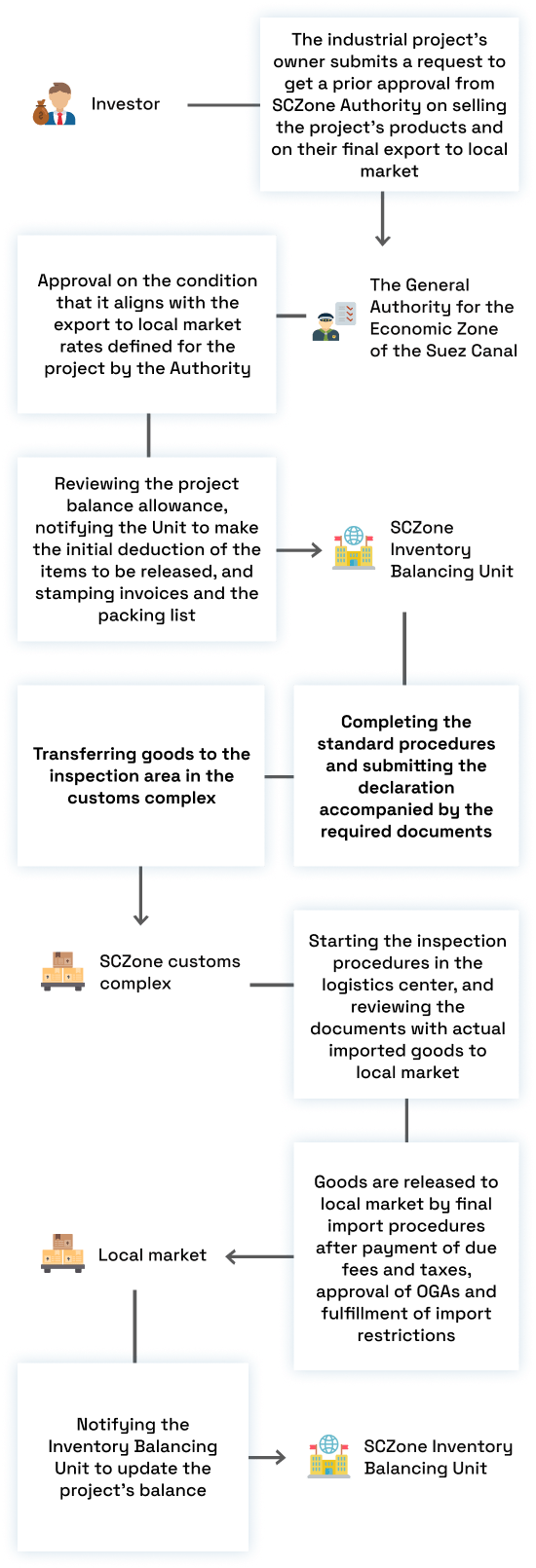

Process Diagram

Key Steps of Work Procedures

Starting the registration process of the project in the SCZone, and submitting an inbound form for the SCZone Authority approval on final export to local market using the official forms to initiate and start the customs procedures.

Completing the standard procedures of the Central Manifest department and submitting the customs declaration.

Transferring goods to the inspection and examination area to complete the inspection procedures and, they can be examined by OGAs (Other Governmental Authorities) in SCZone, if required.

Releasing and delivery of goods to the project, in addition to updating the project’s inventory balance.

Regulatory Requirements and Controls

1

A valid commercial register

2

A valid operating license or permit to practice the project activity

3

Tax card

4

The company is registered at the Customs Stakeholder Unit, by virtue of a letter submitted by the SCZone Authority

5

Prior approval issued by the SCZone Authority board of directors on the sale and disposal of the industrial projects’ products in accordance with export to local market rates specified for the project

Shipping and Commercial Supporting Documents

Invoices

Packing list

Production Composition Certificate (PCC) of local and foreign components approved by the SCZone Authority and the project

SCZone Authority’s approval

Registration number in the register of the Customs Stakeholder Unit

SCZone Authority Procedures

1. The project or company representative shall request the SCZone Authority to approve an original and copy of the export declaration from the SCZone to the local market using the specific form, indicating the goods to be exported to the local market attached with a detailed initial invoice listing the goods items to be exported to local market

2. The Authority shall approve the declaration stating that the project operates under the economic zones system and that the goods mentioned in the declaration are within the rates specified by the SCZone Authority for the project to export to local market

Customs Procedures in the SCZone Customs Complex

1. Prior to submitting the declaration, the stakeholder or their representative shall request the Inventory Balancing Unit at the logistics center to review the project’s balance capacity, as well as notify the Unit to make the initial deduction of the items to be exchanged, stamp the invoices and the packing list with the balances’ seal

- The project representative shall submit the data electronically through one of the following ways:

- EDI

- XML

- Direct submission by the external offices of the shipping agencies or their representatives

- Online submission through the official portal of the Economic Zone for customs services

- Direct submission by the employee of the customs logistics center in SCZone.

- Receive the declaration file and review the attached documents, verify the identity of the applicant, and sign the customs declaration.

- Add the number 46 KM (declaration serial number) to the documents attached to the declaration file.

- Send copies of the (electronic declaration + invoices + packing list + PCC of local and foreign components) electronically to the customs administration of the developed customs logistics center and the inspection committees in the SCZone customs complex.

- Informs the customs committees of the declarations and consignments to be inspected by them, in addition to the consignments that need to be verified by OGAs or security bodies (in the case of centers electronically linked to the inspection areas). The stakeholder or their representative shall receive exact copies of the original (packing list and invoice – declaration) to be submitted to the inspection areas.

- The Customs Committee shall determine the due taxes and fees according to Article (20) of the executive regulations of the law, the collection of such taxes and fees, the fulfillment of the OGAs procedures, and the import restrictions issued by SCZone Authority Board of Directors

- In the event that the item shall be examined, the representative of the General Authority for Export and Import Control in the SCZone shall send copies of the documents of the declaration to be submitted to the quality control, in order for the quality controller to: –

- Determine the inspection fees for the requests submitted to him/her.

- Receive of a statement of payment of examination fees.

- Complete his/her signature on the customs declaration, and the declaration and its documents shall be kept in the archive designated for this.

4. The Customs committee sends the consignment data to the Inventory Balancing Unit for final deduction from balances after completion of goods exchange and release

Operational Requirements and Controls

- Products manufactured by the SCZone industrial projects and exported to the local market are subject to the general rules issued by SCZone Authority’s board of directors and such products are treated as stipulated in Article (20) of the executive regulations of the law of Economic Zones Law of a Special Nature.

- The SCZone industrial projects may pay and collect the prescribed taxes and fees on the foreign component on behalf of the importers upon release to the local market and submit them to the Customs Authority.

- In the case of importation from outside the country of raw materials or production requirements that need quality examination by the concerned OGAs in application of sovereign decisions issued in this regard, the quality of such items shall be examined and they shall not be released until after the completion of the examination and conformity. The final product of the industrial project shall be examined upon entering the local market in case the quality if the item is examined and in accordance with the Egyptian standard specifications for the item and without being subject to the sovereign decisions again due to the previous examination of the component when imported from outside the country, with the payment of all taxes and customs duties upon filing the declaration.

- SCZone industrial projects may file a consolidated declaration for one quantity monthly for each importer separately, according to the related form (import declaration of products manufactured in the economic zone to the local market) with payment of all taxes and customs duties for each disbursed part upon completion of the exchange, provided that the balance and the entry are settled in a special ledger for the project and the Inventory Balancing Unit shall be notified. The exchange is made for each quantity for which a customs declaration has already been filed in the presence of representatives of the customs department in SCZone with representatives of the SCZone Authority at the project site.

Examination and Inspection Controls at the Customs Complex

- It is not permissible to inspect the imported consignments to the country by any customs entities working in SCZone before the start of the customs procedures and in the presence of the representatives of the customs administration.

- If any of the OGAs or security bodies has information about the goods, they shall inform the customs to investigate this during the completion of the customs procedures and the body giving the information shall attend during the procedures completion.

- In cases other than green path release, the minimum percentage of examination of any consignment, including auto spare parts, is 5% of the number of packages of each container, provided that the invoices and approved packing lists shall be submitted, and they shall include numbers, quantities and brands or trademark, item number and other numbering, signs and letters that identify the item. The concerned tariff manager may reduce this percentage in case of large consignments or those breakable ones if their packages are homogeneous.

- All the packages of the consignment are opened and examined in detail with the knowledge of the inspection committee at the customs complex in the following cases:

- Consignments of used goods

- Stocks

- Fully returned consignments

- Failure to submit packing lists as per the above-mentioned rules

- The contents of the packages differ from that of the packing lists that meet the required conditions.

- Availability of information about a violation in the consignment

- Presence of unidentified packages free of trademarks printed on them within the consignment, or these trademarks are written by hand.

- If the content of one of the consignment’s packages selected to be opened violates the data contained in the submitted documents.

- In case of failure to submit a packing list or weight statement that is accepted by customs.

- If the customs committee requests to inspect all the consignment packages if they are suspicious (after the approval of the Executive Director of the SCZone Customs).

- It is sufficient to inspect the bare goods (those whose value is determined by weight) if the consignment content is visible to the naked eye.

- In the event of releasing goods imported for re-exportation under any of the customs systems, these imports shall be inspected and checked so that they due diligence.

- The following consignments shall be examined by X-ray:

- Consignments containing one package and that with similar packages.

- Consignments that the competent customs see the importance of being examined by X-ray, provided that the reasons shall be indicated on the customs declaration with the knowledge of the committee chairman or his/her delegate.

- The stakeholder may, upon their request, withdraw samples for examination and analysis on their own, which is (not binding on customs) before or during the procedures under customs observation and payment of taxes and fees due thereon.

- Confirmation on the notifications that take place between the examination and inspection area and the Inventory Balancing Unit without mediating the stakeholders and in an automated manner.

Related Important References and Resources

- Article (20) of the Executive Regulations of the Economic Zones of a Special Nature law

Explanatory Questions and Answers

SCZone’s projects shall only export to the local market within the limits, rates, quantity, and time period stipulated in the operating license issued by the SCZone Authority. When the project undertakes an export process, it shall first obtain prior sale and disposal approval from the board of directors of the SCZone Authority in accordance with the rate specified therefor.

Projects with high export rates to the local market of their finished product, and based on their desire, may submit a request to waive the benefits of tax suspension regarding the imports only of raw materials and production requirements used in manufacturing, and and hence the project shall operate under the Final Import system. This is determined by the SCZone Authority’s approval on the inbound forms issued to the port and has any restrictions or controls regarding it. While the tax continues to be suspended for its imports of assets, production lines, spare parts, machinery, and special equipment in accordance with the law. In the event that this system is followed, these projects may not combine the final import system with another special tax-suspended customs system when dealing with raw materials and production requirements, and all taxes and fees shall be paid by the final import system before the release and the completion of the examination by the quality control authorities

All the packages of the consignment are opened and examined in the following cases:

- Consignments of used goods

- Stocks

- Fully returned consignments

- Failure to submit packing lists as per the above-mentioned rules

- The contents of the packages differ from that of the packing lists that meet the required conditions.

- Availability of information about a violation in the consignment

- Presence of unidentified packages free of trademarks printed on them within the consignment, or these trademarks are written by hand.

- If the content of one of the consignment’s packages selected to be opened violates the data contained in the submitted documents.

- In case of failure to submit a packing list or weight statement that is accepted by customs.

- If the customs committee requests to inspect all the consignment packages if they are suspicious (after the approval of the Executive Director of the SCZone Customs).

- It is sufficient to inspect the bare goods (those whose value is determined by weight) if the consignment content is visible to the naked eye.

- In the event of releasing goods imported for re-exportation under any of the customs systems, these imports shall be inspected and checked so that they due diligence.