Export Support Program

About the program

A distinguished program to support and develop the Egyptian exports that is launched by the Egyptian government to encourage the local industry, develop the support system provided to exports, and support exporters to make the Egyptian exports access various global and regional markets; and thus enhancing the growth of the national economy.

Main Objectives and Benefits of the Program

Encouraging and Expanding the Egyptian Industry, Increasing the rate of the local component used in manufacturing the final exported products, and Reducing the quantities of imported inputs and production supplies

- The value-added standard is applied so that the support value to exporters is determined according to the added value of exports, provided that the minimum value-added is 30%. The support rate increases with the increase in the added value of exports. This is determined according to the local component certificate issued by the Industrial Development Authority and approved by the Federation of Egyptian Industries.

Developing Upper Egypt, Border Areas, Damietta Furniture City, and Al Roubiky City

- An additional 50% of the basic support is granted to the exports of factories established in Upper Egypt governorates and these regions.

Developing the Suez Canal Economic Zone (SCZone) and Supporting its Established Projects.

- The projects established in the zone are granted the same rate of basic support provided to the exports of the factories established in the interior regions.

Enhancing Egyptian Export's Access to Africa and New Markets

- Exports to Africa are granted an additional 50% of the basic support rate and 50% of the shipping cost to Africa is assumed for all exports except for the goods excluded.

- Exports to new markets are granted an additional 50% of the basic support rate. The new market countries include countries such as China and its administratively affiliated countries such as

Hong Kong and Taiwan, Azerbaijan, Armenia, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Uzbekistan, Ukraine, Brazil, Mexico, Colombia, Argentina, Peru, Venezuela, Chile, Guatemala, Ecuador, Cuba, Bolivia, Haiti, Dominican Republic, Honduras, Paraguay, El Salvador, Nicaragua, Costa Rica, Panama, Puerto Rico, Uruguay, Guadeloupe, Martinique, Guyana French, Saint Martin, Saint Barthelemy, Australia, New Zealand, Japan, South Korea, Canada, Indonesia, Vietnam.

Supporting Transport, Air Cargo, and Shipping to Africa

- Providing support to Egypt Air Cargo Company to help it to introduce strategies of reduced rates to support exports from all other airlines.

- A support program granted for all exports heading for Africa, except for the excluded goods.

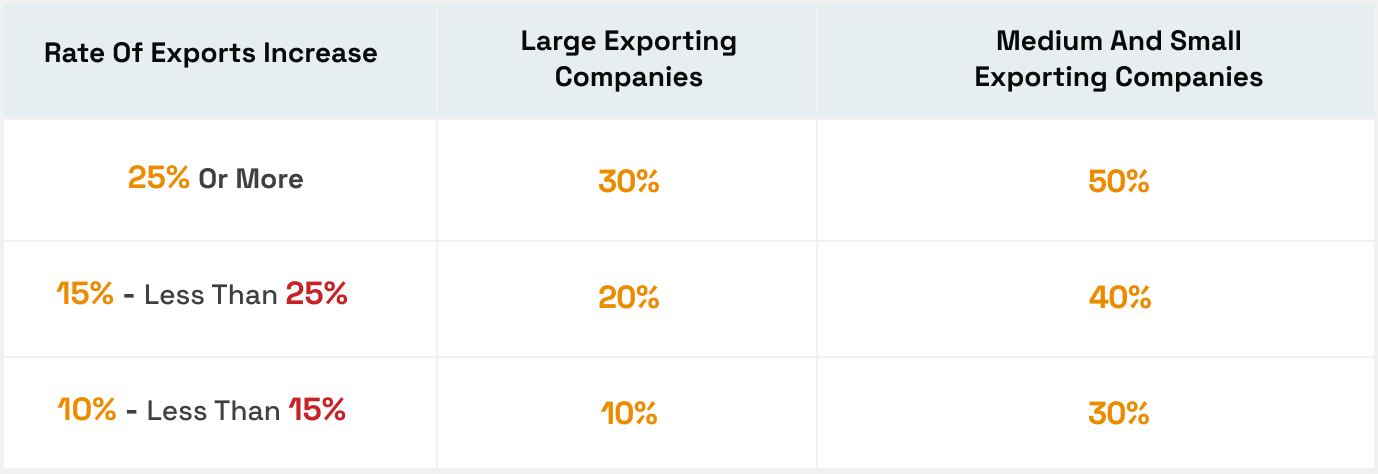

Supporting the Increase of Exports and Motivating the Exporting Companies to Increase the Volume of their Exports Abroad

- An additional support rate is granted to companies for the increase of their exports as follows:

Supporting the Export Infrastructure and Establishing & Providing Services that Benefit the Various Export Sectors

- 15% of the budget of the Export Support Program is allocated to cover the costs of infrastructure projects, including the Exhibition Support Program, Fruit Fly Control Project, Export Guarantee Program, Ro-Ro Lines Support Program, and the proposals of business organizations.

Target Sectors

Agricultural Crops

all exports of vegetables, fruits, medicinal and aromatic plants, flowers, herbs, and peanuts

Food Industries

all food industries except strategic goods

Textile Industries

spinning and weaving – clothing and accessories – furnishings

Chemical Industries and Related Industries

packaging products, glass products, plastics, soaps, detergents, and some chemical products

Furniture

furniture of all kinds, mattresses, and wooden crafts

Building Materials

marble, granite, insulating materials, galvanization, flat glass, wire drawing, and ceramics

Medical Industries

medical supplies – medicines – cosmetics

Leather

leather products and shoes of all kinds

Engineering Industries

electrical appliances, electronics and parts thereof, automotive feeding industries, household utensils, pumps, metal products, computers and spare parts thereof, agricultural machinery, electrical equipment, meters, dies, razor blades, passenger cars and commercial vehicles

- Program Timeframe

The duration of the program is up to 3 years since it is effective in July 2023, coinciding with the start of implementing the automated system of the export support program.

Mechanism of Support Calculation and Disbursement

70%

70%

- The support due to exporters is disbursed in cash at a rate of 100%, through which any dues owed by exporters shall be settled in favor of the Ministries of Finance, Petroleum and Electricity.

- The support amount is disbursed to exporters within 3 months after completing the required documents.

Documents Required to Register Companies in the Program

The following is the set of documents required from exporters to register in the Export Support Program to get the financial support:

01

Commercial register

02

Tax identification card

03

04

VAT certificate stamped by the SCZone Authority.

05

SAD form stamped by the customs authority and directed to the foreign trade sector.

06

Commercial invoice stamped by the SCZone Authority.

07

Bill of lading stamped by the exporting company.

08

Bank document stating remittance of funds or bank deposit for the excluded countries.

The originals of the required documents shall be submitted for review