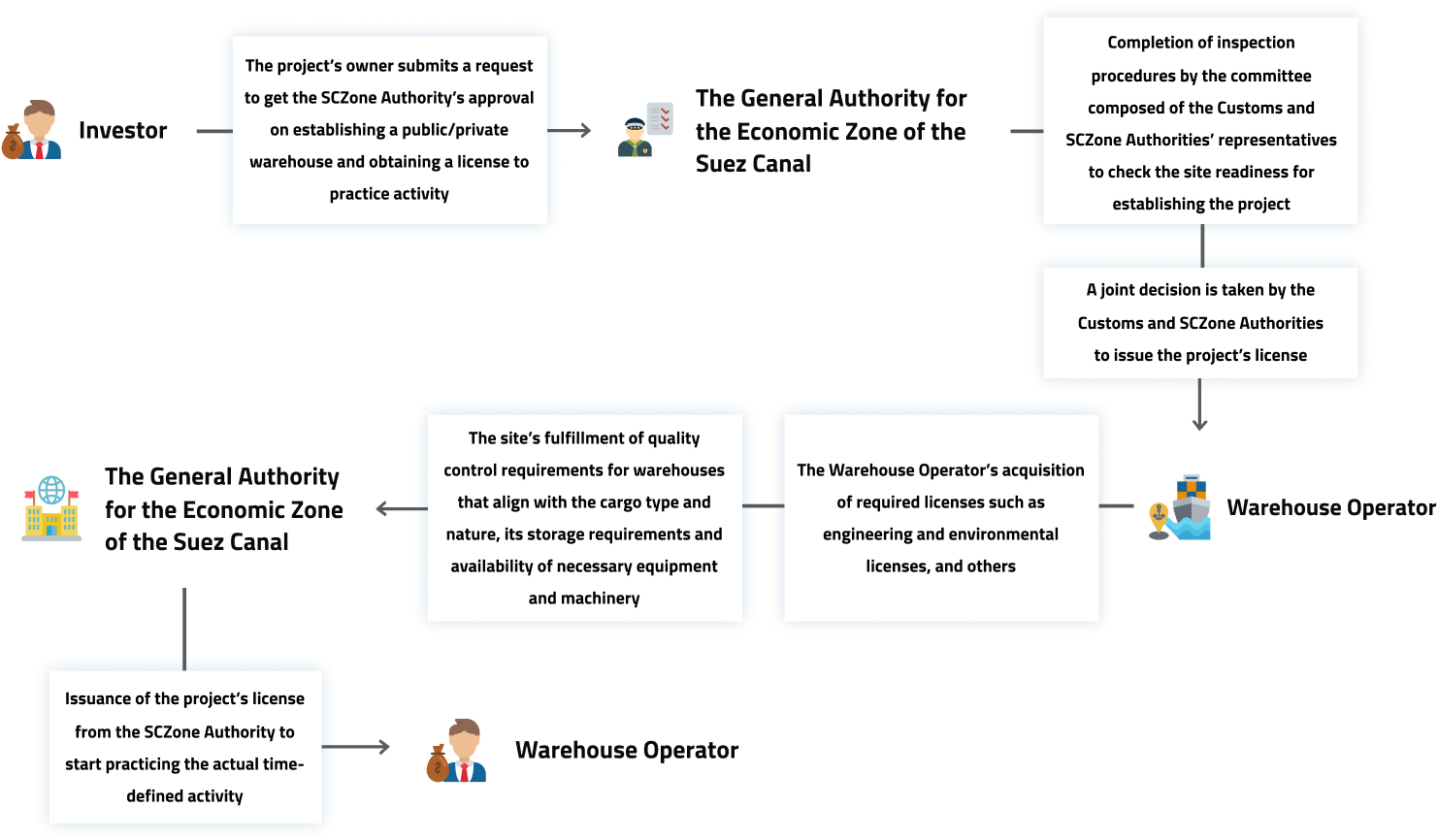

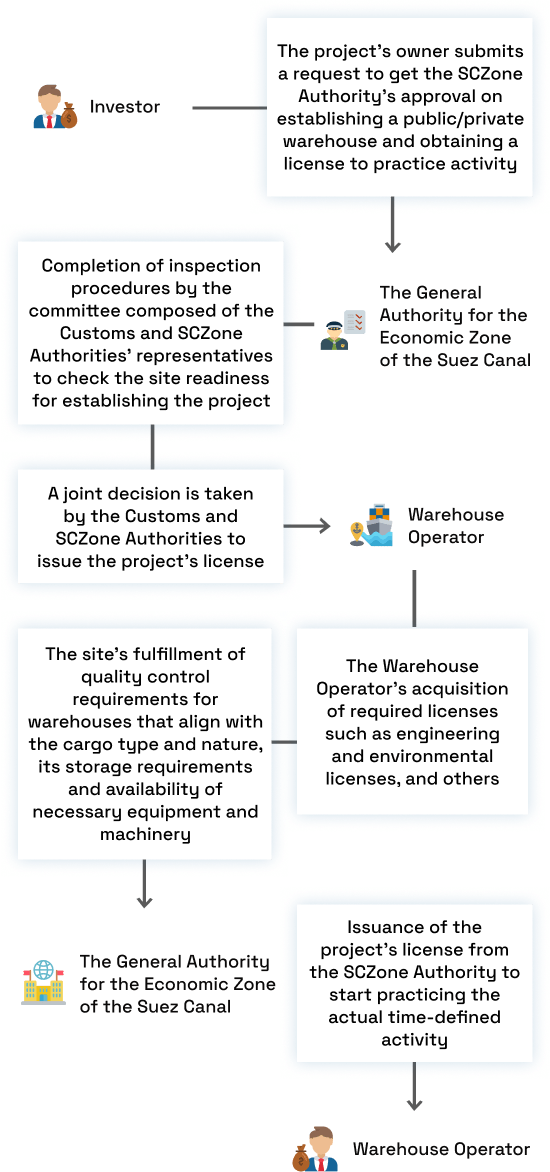

Establishment of Public/Private Customs Warehouse and Issuance of License to Practice Activity

Description and Purpose of the Process

These procedures apply to the SCZone projects, and its employees or agents authorized by the validity of a bank signature in favor of the project to finalize the procedures for issuing a license to practice the activity of public/private customs warehouse. All information related to such process and the necessary procedures are provided for the projects to comply with when submitting a request for approval on the establishment of the warehouse in the SCZone.

Process Diagram

Key Steps of Work Procedures

Submitting a request to get the General Authority for the Economic Zone’s approval on establishing the project and obtaining a license to practice activity.

Completion of inspection procedures by the committee composed of the Customs and SCZone Authorities’ representatives to check the site readiness for establishing the project.

A joint decision is taken by the Customs and SCZone Authorities to issue the project’s license.

Issuance of the project’s license from the SCZone Authority to start practicing activity after fulfilling the warehouses quality control requirements.

Regulatory Requirements and Controls

1

A valid commercial register

2

Tax card

3

The company is registered at the Customs Stakeholder Unit, by virtue of a letter submitted by the SCZone Authority

4

Prior approval issued by the SCZone Authority board of directors on project establishment

5

A joint licensing decision taken by the Customs and SCZone Authorities

6

Valid license to practice activity issued by the SCZone Authority

Shipping and Commercial Supporting Documents

Authority’s approval on project establishment

A joint licensing decision taken by the Customs and SCZone Authorities

Registration number in the register of the Customs Stakeholder Unit

A surety to cover customs tax and all types of due taxes and fees for the loss or damage of stored goods

Statement proving the fulfillment of warehouses quality control requirements

SCZone Authority Procedures

1. The project or company representative shall submit a request to get the SCZone Authority’s approval on project establishment and registering the project activity in the commercial registry as storing in public/private customs warehouses

2. The project’s representative shall submit a request to the SCZone Authority to obtain the license to practice activity using the related form though the SCZone Trade system, including all information and coordinates on which the project will be established, in order to start the licensing and inspection procedures by a committee of representatives of the Customs and SCZone Authorities to check the site readiness for establishing the project and its fulfillment of the quality control requirements, and acquisition of the necessary licenses (engineering, environmental, etc

Customs Procedures in the SCZone Customs Complex

1. The committee inspects the site to verify its readiness to establish the project and its fulfillment of quality control requirements and controls to practice activity

2. A joint licensing decision is taken by the Customs and SCZone Authorities for the project that defines the activities to be carried out in the warehouse and the nature of goods to be stored (industrial – food – full goods containers – empty goods containers) with the aim of checking the condition of the warehouse and preparing it in accordance with the type and nature of goods, storage requirements and the availability of equipment and devices to implement this

3. A license to practice the project’s activity is issued by SCZone Authority to start the actual practice and its time is defined

4. The project is registered in the Customs Stakeholder Unit application in the SCZone logistic center

Controls of Public Customs Warehouse License Transfer to Operate under the Economic Zones of a Special Nature Law

To operate under the Economic Zones of a Special Nature law, the warehouse shall be located within the co of the SCZone geographical terrority, and the warehouse shall have no customs violations in the previous two years before joining

Submission of a (transfer/registration transfer) request to work under the umbrella of law No. 83 of 2002 on the related SCZone form attached with all documents proving the practice of customs warehousing activity, commercial registry, and all incorporation documents

Approval of SCZone Authority on the (transfer/registration transfer) of the warehouse and registration in the commercial registry to practice the storage activity in public warehouses

Operational Requirements and Controls

- It is permissible to expand or modify the coordinates of the warehouse through an appendix to amend the joint decision issued by Customs & SCZone Authorities. No change shall be made to the warehouse location or its area unless after notifying the SCZone Authority and obtaining a decision on such modification.

- Adherence to all regulations and decisions issued by the SCZone Authority and compliance with all provisions of the Customs law and its executive regulation for matters for which no specific provision is laid down in the executive decisions of SCZone customs system.

- Adherence to the applicable customs procedures and controls and bearing responsibility for any violation by the company’s workers and employees of these procedures.

- It is permissible to complete the customs procedures on the goods after they are transferred to the warehouse through the customs committees supervising the warehouse.

- The competent customs unit shall have the right to review documents, records, correspondences, and commercial contracts of any type, and the operating company shall keep all documents for a period of no less than (5) five years from the completion of customs operations.

- The SCZone Authority, in accordance with the laws and decisions in force, may take what it deems appropriate for goods whose disposal cannot be ascertained during the inventory process conducted by Authority’s employees.

- If any shortage appears in the goods deposited in the customs warehouse for any reason, the investor shall be responsible for such shortage before the SCZone and Customs Authorities, and the investor shall pay the customs duties due for the missing goods, in addition to being subject to the provisions of the general law of (violations and penalties).

- The investor shall cooperate with the customs team in charge of direct supervision of the goods and customs warehouses through their commitment and adherence to the instructions issued to them by such team, which are necessary for proper functioning of the warehouses.

- In the event that the goods stored in the customs warehouse are damaged as a result of negligence by the investor, the customs duties shall be due for the value of the goods as of the date of their deposit in the warehouse.

- In the event that the goods stored in the customs warehouse are damaged as a result of natural disasters or force majeure, the SCZone Authority can re-evaluate the goods for the purposes of collecting customs taxes

- On transferring a consignment from the port to the warehouse, the goods of one customs declaration shall not be splitted, and it shall be transferred completely to one warehouse.

- The site of the warehouse shall not be used for any purpose other than the licensed for one, except after obtaining a written approval from the SCZone Authority.

- It is prohibited to store used cars imported for the Disabled inside the warehouse, provided that the regulations issued by the SCZone Authority regarding cars for the disabled when entering the local market shall be applied in accordance with the SCZone Authority board of directors’ decision No. (52) of 2021 except for the warehouses licensed before the issuance of the rules and procedures of the SCZone customs system No. 76 of 2020.

- Foreign goods that are not free of customs tax shall be transferred to warehouses established in the SCZone under the transit system and in accordance with the financial guarantees provided for in the Customs Law only, and which are provided for the benefit of the Customs Authority exclusively. No other type of governmental guarantees or commitments regarding the storage of goods in warehouses shall be considered.

- The licensed warehouse operator to exploit the warehouse shall not submit the customs declaration and transfer goods for deposit in the warehouse before obtaining the approval of the SCZone using the related form. This is for commercial statistics purposes, and to confirm that there is no violation from the licensee side, considering that the SCZone Authority approval is not an undertaking by the Authority to guarantee taxes and fees on the goods.

- The public warehouse operator shall not import goods in their name to be stored in the warehouse, and their role is limited to the exploitation of the warehouse, storage for third parties, and the guarantee of goods, and the consequent responsibilities, duties and obligations stipulated in the matter of warehouses in the customs law and its executive regulations.

- When exchanging and releasing the goods deposited in the warehouse, one bill of lading may be splitted to an unspecified number for the duration of the authorized storage period, provided that the joint licensing decision issued to the warehouse stipulates these procedural advantages and the decision number of the board of directors or its delegate in this regard.

- The customs warehouses are subject to the control of the SCZone Authority, and the warehouse operators are responsible for the goods deposited in their warehouses in accordance with the provisions of the laws in force. The investors shall be responsible before the SCZone Authority’s board on behalf of the goods owners for all their obligations related to the goods deposited.

- SCZone Authority board of directors may, according to what is required for the public interest of the country, allow warehouses that specialize in storing one item type, spare parts for machines and production lines, electronic or electrical equipment and devices, or raw materials to extend the storage period for further times.

Control & Governance Requirements for SCZone Warehouses

- The warehouses shall fulfill all the quality control requirements and shall comply with the import and export rules of SCZone regulations or with the rules of the general import and export law in case not mentioned in the SCZone ones.

- The project shall be surrounded by a safe fence from all sides and suitable gates to control entry, and shall have special main entrances, provided that these fences and buildings are tightly closed.

- If a license is issued for various storage activities within the coordinates of the same warehouse (for the interest of others/for the investor’s interest/tax exempted/ tax suspended), each activity shall be separated from the other by separate fences, walls, and entry and exit gates.

- The project shall have yards in which customs procedures can be completed (unloading – detection – handling – …).

- The project shall be equipped with all services and equipment for occupational health and safety and civil defense procedures, in order to secure the necessary equipment to maintain the safety of the deposited goods to prevent the causes of damage or fire and to facilitate the process of downloading, loading and storing goods of all kinds.

- The engineering office and the competent customs department, each within its jurisdiction, shall ensure that all necessary requirements are met in the customs warehouse.

- The warehouse design shall comply with the engineering designs approved by the SCZone Authority in a way that enables the competent customs department to make inventory at any time in accordance with an appropriate inventory management system.

- Equipping the warehouse with digital surveillance cameras according to the needs that the SCZone Authority and the competent customs department see.

- The warehouse shall contain service facilities, offices and places equipped to carry out customs procedures for the goods entering the warehouse from the moment they enter the warehouse until they are exchanged for export.

- Adherence to the procedures and instructions on linking warehouses to the SCZone Customs System, to follow up on the storage process, entry and exit of goods to/from the warehouse, provided that the SCZone Authority shall be provided with the following statements:

- A statement signed by the legal representative of the project every six months of the imported materials and goods from outside the country that have been stored in the warehouse in terms of type, number and value according to the invoices related to the goods when they are received at the warehouse.

- A statement every six months of the materials and goods that have been exchanged from the warehouse in terms of type, number and value according to the invoices related to the goods when they are received at the warehouse.

- An annual statement of goods and materials that are still being deposited in the customs warehouse and have been imported from outside the country.

- A statement of the goods deposited into the warehouse that have been imported from the local market and a statement of what has been exported from them, and the remaining balance as requested by the competent customs office.

Related Important References and Resources

- Law No. 83 of 2002 on Economic Zones of a Special Nature

- SCZone Authority Board of Directors Decision No. 52 of 2021

- Rules and Procedures of SCZone Customs System issued for working with the customs regulation of the Suez Canal Economic Zone No. 76 of 2020

Explanatory Questions and Answers

The SCZone Authority issues this license for the concerned project after a joint licensing decision is taken by the Customs and SCZone Authorities.

The storage period in warehouses is one year, and this period may be extended for less than one year by virtue of the SCZone Authority board of directors’ decisions or its representatives.

It is possible when depositing and releasing the goods stored in the warehouse to divide one bill of lading into an unspecified number of bills during the authorized storage period as per the limits defined by virtue of the Customs Law and its executive regulations, provided that these procedural advantages shall be stipulated in the joint license issued for the warehouse. However, when a consignment is transferred from the port to the warehouse, the bill of lading of one customs declaration shall not be divided, and it shall be transferred completely to one warehouse.

Warehouses are used for the purposes of storage, packaging, encoding, splitting bills of lading, re-shipping consignments, or shipping abroad, as well as setting up and organizing exhibitions, provided that the customs duties of goods and commodities stored in the public customs warehouses shall be covered by surety paid by the warehouse operator.

- A statement signed by the legal representative of the project every six months of the imported materials and goods from outside the country that have been stored in the warehouse in terms of type, number, and value according to the invoices related to the goods when they are received at the warehouse.

- A statement every six months of the materials and goods that have been exchanged from the warehouse in terms of type, number and value according to the invoices related to the goods when they are received at the warehouse.

- An annual statement of goods and materials that are still being deposited in the customs warehouse and have been imported from outside the country.

- A statement of the goods deposited into the warehouse that have been imported from the local market and a statement of what has been exported from them, and the remaining balance as requested by the competent customs office.